Introduction

In the world of finance, understanding risk is crucial. While there are many metrics and indicators that can help investors gauge the risk associated with a particular investment or a portfolio, one of the most significant metrics is the Maximum Drawdown. This article sheds light on this vital metric and explains its importance in portfolio management.

What is Maximum Drawdown?

Maximum Drawdown (MDD) is a measure used to quantify the largest single drop in the value of a portfolio or an investment from its peak to its lowest point over a specific time period. Usually expressed as a percentage, MDD gives investors an idea of the worst-case scenario they might expect from their investment.

For instance, if an investment portfolio was worth $1 million at its peak and then dropped to $700,000 before rebounding, the Maximum Drawdown would be 30%.

Why is Maximum Drawdown Important?

- Risk Assessment: MDD provides insight into the potential volatility and risk associated with an investment or a portfolio. A higher MDD indicates higher volatility and potentially more risk.

- Investor Psychology: Large drawdowns can be distressing. Understanding the MDD can help investors gauge their emotional capacity to handle significant drops in value without making impulsive decisions.

- Comparative Analysis: By comparing the MDD of different investments or portfolios, investors can assess which option is more resilient during adverse market conditions.

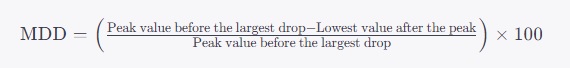

Calculating Maximum Drawdown

The formula for Maximum Drawdown is:

This will yield a percentage which represents the MDD.

How to Use Maximum Drawdown in Investment Decisions

- Risk Tolerance: Investors should understand their risk tolerance. A portfolio with a high MDD might not be suitable for conservative investors, even if it promises higher returns.

- Historical Context: While MDD provides a picture of historical losses, it's essential to understand the context. Was there a significant market event? How did other similar investments fare during the same period.

- Diversification: One of the best strategies to mitigate the risk of large drawdowns is through diversification. A well-diversified portfolio is less likely to experience large drawdowns compared to a concentrated one.

Limitations of Maximum Drawdown

While MDD is a powerful tool, it is not without its limitations:

- Past Performance: Like many other metrics, MDD is based on historical data. It doesn't predict future performance or drawdowns.

- No Timeframe: MDD doesn't consider how long it might take for an investment to recover from a drawdown.

- Not Comprehensive: Relying solely on MDD without considering other risk metrics can provide a skewed perspective on the potential risks associated with an investment.

Conclusion

Maximum Drawdown is a crucial metric that provides insights into the worst-case historical loss of an investment or portfolio. While it's an essential tool for assessing and understanding risk, it's equally important for investors to consider other metrics and strategies, like diversification, to ensure they have a comprehensive understanding of their investment's risk profile.